Australian health funds paid a record $23.6 billion for healthcare in 2023 as claims by health funds members hit a new high, exceeding pre-pandemic levels.

Health fund membership is also at an all-time high with over 14.73 million Australians choosing private health cover. This follows 14 consecutive quarters of membership growth. The pandemic brought home the value of private health insurance for consumers, which is to access surgery at a time of their choosing and inpatient mental healthcare when and where they need it.

APRA’s quarterly report, released today, shows benefits paid by health funds in 2023 totalled $23.6 billion, an increase of 10.2 percent over the previous year. Health funds paid $17.3 billion in hospital benefits, up 11.1 percent on 2022, an increase of $1.73 billion. Extras benefits paid for members totalled $6.16 billion, up 7.6 percent on 2022, or an additional $435 million.

Hospital services totalled 4.92 million, up 9.2 percent on 2022, representing an additional 414,000 hospital episodes. Extras services also hit a record high of 102.4 million for services including dental, optical and physiotherapy, up 6.4 percent on 2022.

Private Healthcare CEO Dr Rachel David said, “Australian health funds are doing everything they can to deliver the best possible value for members at a time when the public hospital system is still struggling to recover from the impact of COVID-19.”

“With health inflation spiralling, and cost-of-living hitting members hard, we therefore need to double down on addressing affordability and stamping out waste. This is critical as claims growth returns to pre-COVID levels.

“The inflated price of generic medical implants and surgical supplies continues to be a challenge. It remains a major factor pushing up costs for heath funds and impacting premium affordability. Furthermore, the number of medical device claims per surgical procedure is continuing to grow disproportionately as a consequence of the sales and marketing activities of the multinational suppliers of these items.

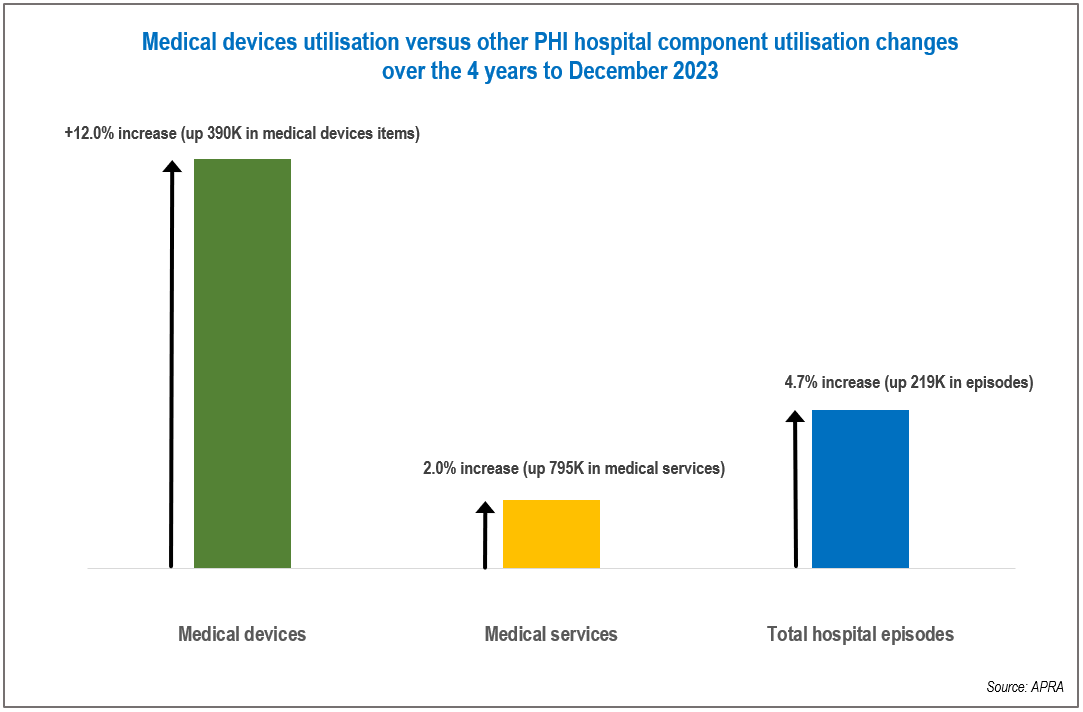

“Health funds paid a record $2.36 billion in medical device benefits in 12 months to December 2023. A four year analysis of APRA data shows the number of medical devices funded by health insurers since the start of the pandemic has surged by 12 percent. This is totally out of proportion to the 2 percent increase in medical services and the 4.7 percent increase in hospital episodes over the four years to December 2023. There is no change in clinical practice that adequately explains this rate of growth.

Australians are paying the highest prices in the world for medical devices – 30 -100 percent more than comparable countries.

“The health sector is not immune to inflation. In addition to the rising costs of health and medical services, like other sectors, health funds are managing increased employee costs, operational and administration expenses, including surging costs for cybersecurity and major IT projects. Management expense ratios for health funds at 10.8 percent compare with 22.6 percent for general insurance.

“Health funds have returned more than $4 billion to members since the start of the pandemic and many funds are still providing cash backs to members as part of their promise not to profit from lower claims during the pandemic. The ACCC confirmed funds were on track to return $4.3 billion to members.

“APRA data shows that health funds on average return 86 cents in every premium dollar back to members in benefits in 2023. In comparison, the general insurance sector on average returned 65 cents in every premium dollar back to members.

“Cost-of-living is hurting, and keeping premiums affordable is a top priority. This requires commitment from regulators and providers to reduce waste in our health system and introduce regulatory changes to increase access to out-of-hospital care and provide flexible, convenient models of care that health fund members expect and deserve,” Dr David said.

Policy measures needed to keep our health system sustainable include:

- Bring the Australian prices of generic medical implants and surgical supplies back in line with global market prices.

- Introduce a Code of Conduct to monitor the sales and marketing activities of big surgical supply companies in Australia, to bring it in line with the pharmaceutical industry.

- Remove low value and harmful medical devices and services from the market as soon as the supporting clinical evidence becomes available.

- Allow health funds to pay for evidence-based out-of-hospital care models provided by all health professional types, in addition to allied health professionals.

- Improve monitoring of out of pocket costs for specialist medical care to enable consumers and their GP to choose an affordable specialist if that is what they want.

- Introduce ‘surprise billing’ legislation with penalties for failure to provide informed financial consent for private medical services.