Health funds paid $21.7 billion* in benefits to members for the year ending June 2020 while weathering the significant market impact of COVID-19 head winds.

The Australian Prudential Regulation Authority (APRA) data has revealed that the impact of the COVID-19 pandemic has seen the net margin of Australia’s health funds fall to a low of 2.8%. This compares with 4.9% in the twelve months to June 2019 and represents a 42% decline in profitability.

CEO of Private Healthcare Australia, Dr Rachel David, said the APRA data puts to bed any suggestion that health funds made ‘windfall gains’ as a result of COVID-19 restrictions.

“No industry sector is immune to the impact of the COVID-19 pandemic. This is a timely reminder that we must bring costs down to keep premiums affordable. The only way to do this is by addressing waste in the system, tackling the inflated pricing of medical devices, removing red tape to allow insurers to fund more care out of hospital will also reduce costs.”

Overall benefits paid for claims in 2019/20 were down by $497 million (-2.4%) on the previous year as a result of the six-week shutdown of elective surgery and some allied health providers because of COVID-19. Benefits paid for claims in the June 2020 quarter were down by 19.2% compared to the same quarter last year.

Funds have already returned savings of over $500 million to members in the form of:

- Postponing the April 1 premium increase for six months;

- Over $120 million worth of financial hardship provisions for over 110,000 members who were unemployed or under-employed as a result of COVID-19; and

- Funding of vital telehealth services for psychology, physiotherapy and more.

“Today’s APRA data shows the impact COVID-19 has had on savings were modest and, in fact, health funds have either returned any savings to consumers already or are using them to fund the backlog of elective surgery,” Dr David said.

“APRA has made it clear that health funds must retain enough capital to fund this backlog of elective surgeries and the additional healthcare needs of private patients.

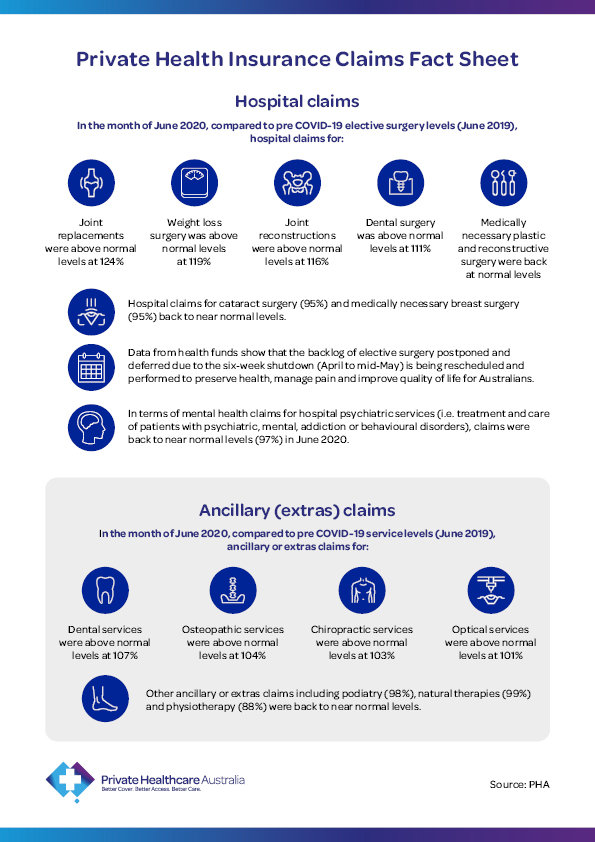

“It’s important to remember that surgeries were postponed, not cancelled, and health insurers are now working with hospitals and doctors to safely and efficiency perform these surgeries. (See PHA Claims Fact Sheet attached)

“The COVID-19 restrictions did not mean the treatment for other illnesses stops. Health funds continued to cover many procedures during this time, including emergency surgeries, pregnancies and in-hospital mental health treatment. Health funds also fast-tracked members’ access to telehealth for physiotherapy, psychology and exercise physiology.”

The number of people with some type of private health cover increased by 9,458 people in the last year. However, PHA acknowledges the decreases in insured persons with hospital treatment – down 0.27% over the 12 months to June 2020 and down 0.23% over the June 2020 quarter. This data is a reminder that impactful reform needs to be considered to keep young people in cover.

Dr David said a major part of the value proposition for young people to take out private cover, was access to timely mental health treatment which was not available in the public sector:

“Thousands more younger Australians are needing intensive help to manage mental health conditions, even before COVID-19. In 2019, health funds covered 19,455 hospital claims with benefits exceeding $10,000 for people aged under 30. This is an increase of 4.9% compared to the previous year.

“Health funds expect to fund many more high claims for mental health in 2020 as a result of the pandemic.

“Never before has the balance of our private/public healthcare system been so crucial. 13.6 million Australians choose to have private health insurance for the choice and peace of mind it provides. This is especially true now as public hospital wait lists blow out to over 1.5 years for common elective procedures.”

ENDS

*Includes $1.4b of deferred claims liability.

Media Contact: Jen Eddy – 0439 240 755